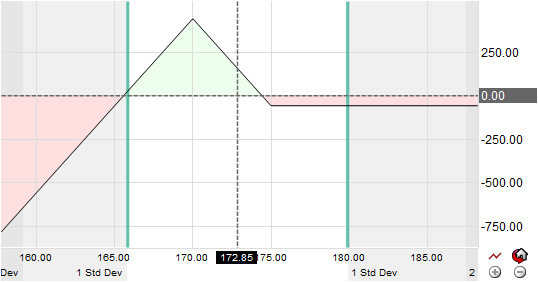

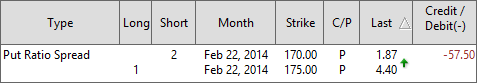

The put ratio spread is a combination of a bull put spread and long put where the strike of the long put is equal to the lower strike of the bull put spread. It entails buying 1 put and selling 2 lower strike put with same expiration.

Summary: The initial cost to establish a put ratio spread is relatively low, and could even result in a credit. The downside potential is excellent. The basic concept is for the total delta of the 2 long puts to equal that of the short put. If the stock moves only a little bit the change in value is limited. However, if the stock declines enough to where the total delta of the 2 long puts approaches 200 the spread begins to act more like a short stock position.