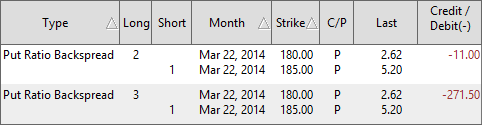

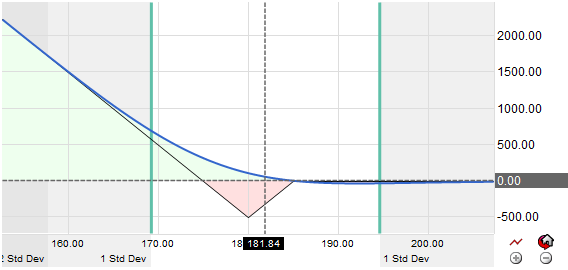

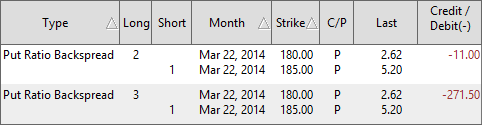

The Put Ratio Backspread is two leg spread designed to take advantage of markets anticipated to move in a bearish direction. The trade is initiated by buying two or three out of the money puts and selling one in the money put. The credit received for selling the in the money put will offset the purchase of the out of the money puts and limit the potential loss for the trade. If the market moves higher than the strike price of the short put all puts expire worthless and the credit received for the short put will offset the value lost on the long puts. If the market makes a bearish move as the trader initially predicted the value of the short put will decrease and create a loss, however the value of the long puts increase and will offset the loss of the short put.

The maximum loss of the trade would be realized if the underlying stock remains at the price of the long puts.