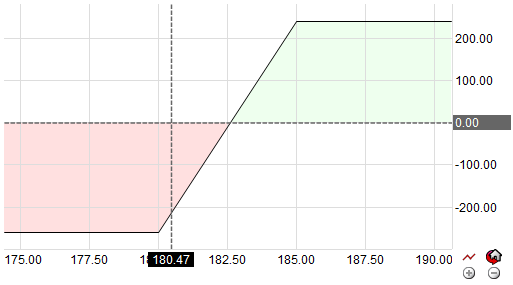

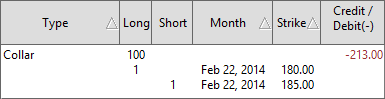

A collar spread is a risk-management strategy where you simultaneously purchase a protective put and write a covered call on a stock you already own. Typically, an investor will establish a collar when concerned with a cost effective way to protect a position. The collar spread can provide short-term protection against a downturn in the stock but it can also limit the upside return at the same time.

Summary: In most cases, collars work best in neutral to bullish markets for a stock that has performed well in the past. Just like any other options strategy, collars require attention to detail and time and are not appropriate for all investors.