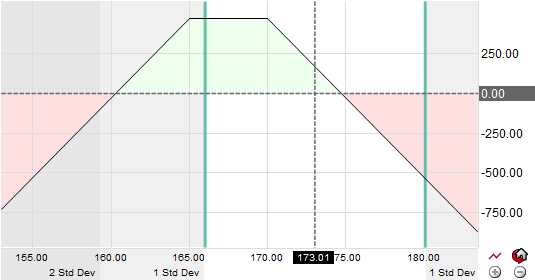

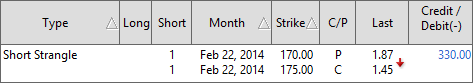

The short strangle spread is a neutral credit options strategy similar to a short straddle spread. It involves selling both a call and put out-of-the-money options of the same stock at the same time. Unlike a short straddle, the options have different strike prices, typically with a higher call strike and a lower put strike. A long strangle typically has a wide spread between the strikes and is cheaper than a straddle but it still requires a larger movement in the underlying asset before the position is profitable. To achieve maximum profit the underlying stock needs to remain between the strike prices of the call and put.

Summary: The strangle spread strategy is a credit spread that is established when the underlying asset is believed to remain neutral and volatility is declining.