The Option Skew tools’ general purpose is to provide the Options Trader a visual display of an option prices’ Implied Volatility so they can compare the values across the range of strike prices in a specific expiration period.

Options Traders whether they are using simple strategies such as buying calls or puts to more advanced strategies such as selling premium use an options volatility values to help establish whether an option has a fair price or is overpriced. Generally, an option that is fairly priced with a lower volatility is a good candidate for purchase while an options contract with a higher volatility value makes a good candidate for selling the premium.

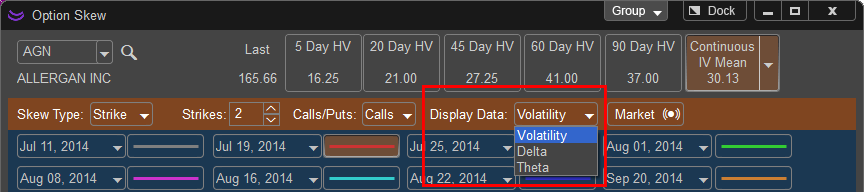

In addition to viewing the skew of volatility the Option Skew feature also allows the trader to view skews based on Delta and Theta.

Options Skew Window

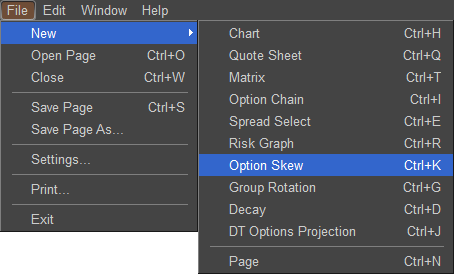

The Option Skew Window can be opened in multiple ways. The first methods is to move your mouse over the SKEW button and press the left mouse button or click on FILE, select NEW, and choose Option Skew; you can also press CTRL-K on your keyboard.

![]()

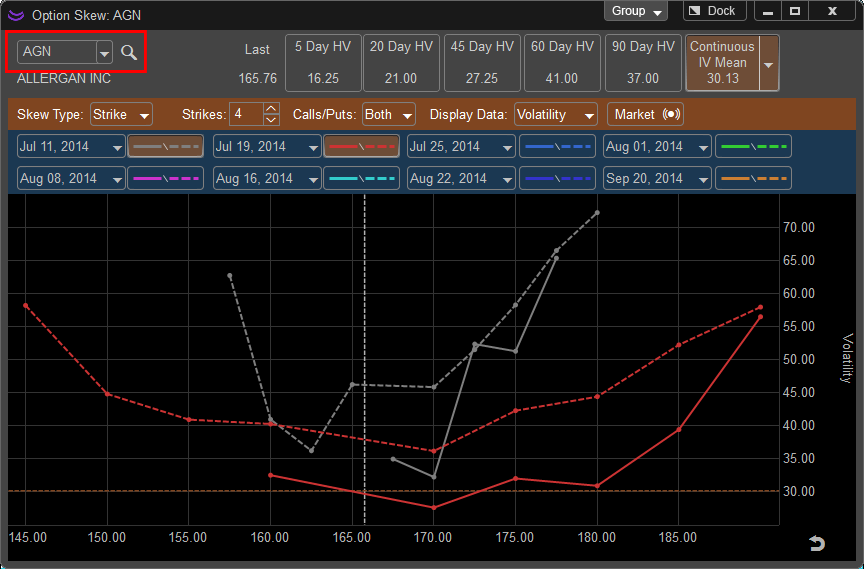

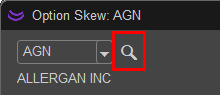

Once the Option Skew window is loaded in your application you can change the symbol by left clicking in the Symbol window in the upper left hand corner of the Option Skew Window. If you do not know the symbol there is a symbol lookup function which can be accessed by left clicking on the  located to the right of the symbol field. Once the symbol is entered press ENTER or on your keyboard to load the Option Skew data.

located to the right of the symbol field. Once the symbol is entered press ENTER or on your keyboard to load the Option Skew data.

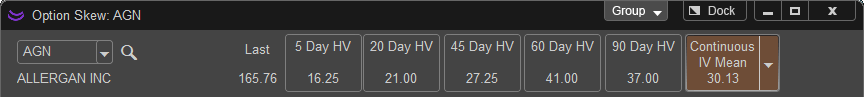

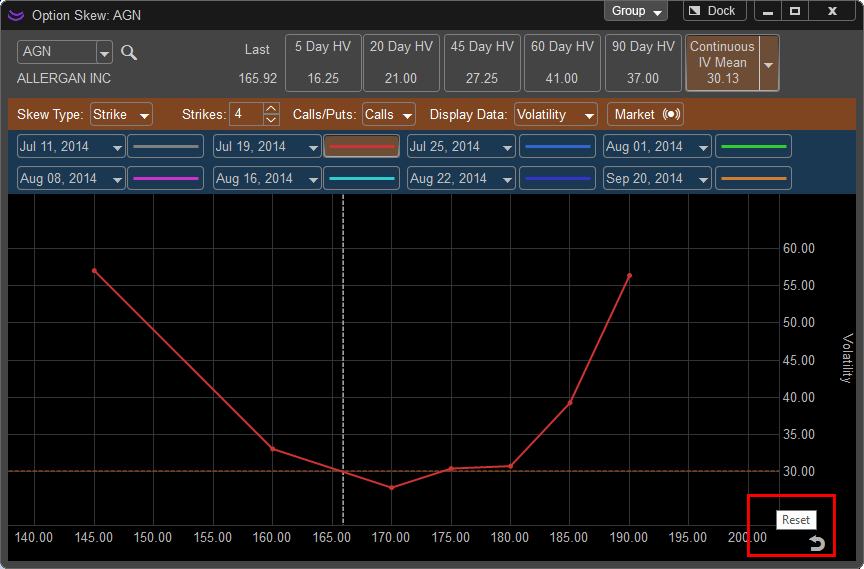

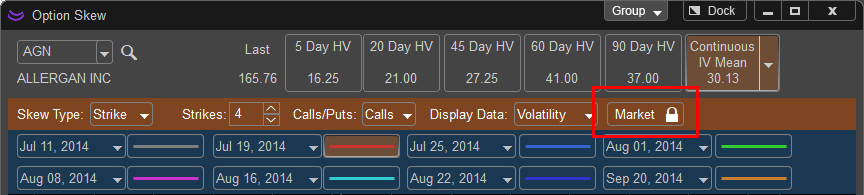

Once the symbol is loaded the window should populate and the company name of the stock symbol you entered will appear directly below the symbol window. In addition, to the right of the symbol window you will be given the last price of the stock which is updated in real time as well as a the values of 5, 20, 60, and 90 Day Historical Volatility and an additional option to see the Continuous Implied Volatility of Calls, Puts, or a Mean of the two.

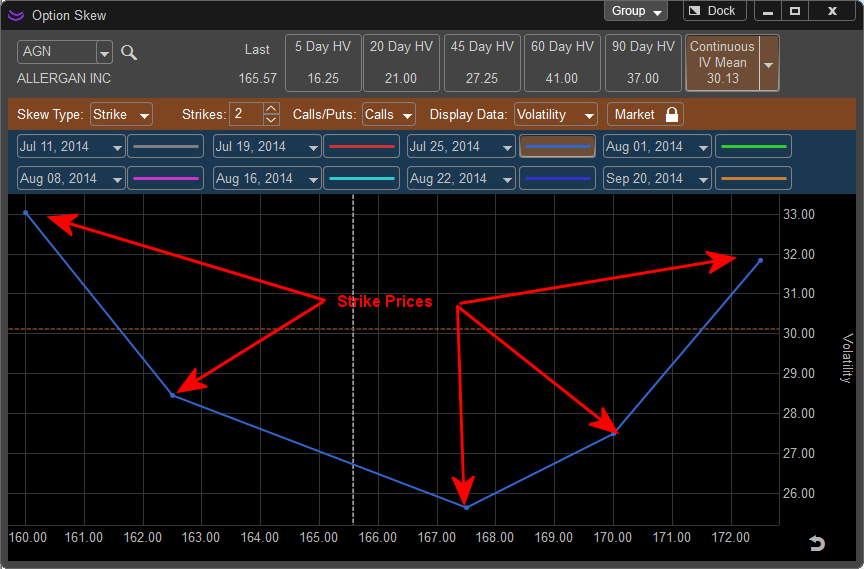

The vertical dashed line on the skew chart represents the current price of the underlying stock and the horizontal dashed line represents the Volatility Value that is selected on the top of the Option Skew window, this defaults to Continuous IV Mean.

The Option Skew window works in similar fashion to the Chart window within the application, it can be adjusted on both axis’ by moving your curser into the Horizontal Axis which represents price and holding down the left mouse button and dragging the cursor. By dragging to the right the Skew Chart zooms in and displays a smaller range of the underlying stock price, by dragging left the chart shows more range of underlying price. You can adjust the vertical scale by moving your curser into the Volatility scale on the left of the graph. To zoom in press and hold the left mouse button and move your mouse up, to zoom out move the mouse down. This will increase and decrease the range of volatility displayed.

To reset the scale back to the original location click the RESET button in the lower right hand corner of the Option Skew window.

The Option Skew charts can be linked with other windows within the application by left clicking on the Symbol button in the upper right hand corner of the window. This allows the Option Skew to sync with other windows within the application, for example if a symbol is changed on a chart the Option Skew will adjust to the same symbol if those windows are linked together.

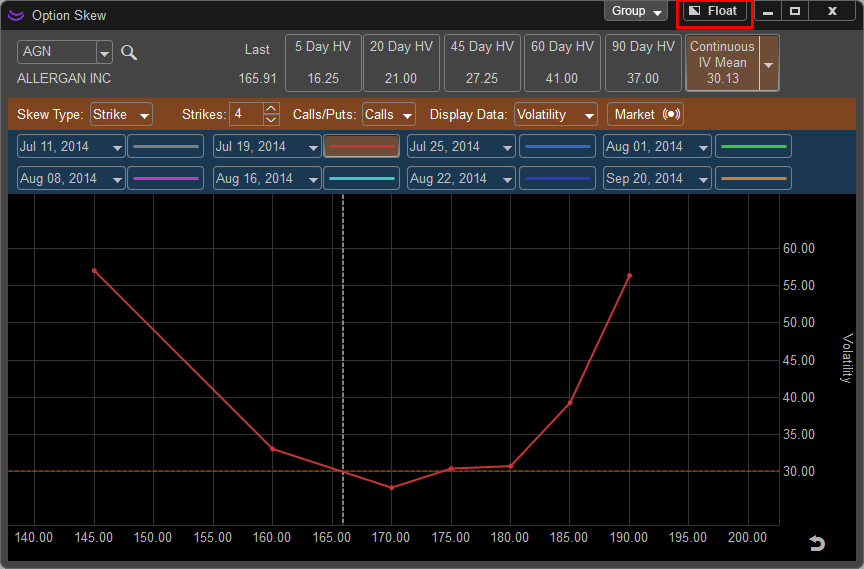

The FLOAT feature allows the window to be removed from the application and moved to a secondary monitor or another part of the desktop. This can be done by left clicking on the FLOAT button and moving the window manually. Once this window is in FLOAT mode the button will be relabeled as DOCK and can be pressed to return the Option Skew window back into the main application window.

![]() Using this option on the chart, enables the chart to be taken out of the main program window. It then can be moved and re-sized anywhere on the screen. When the Page is saved, the window(s) that are outside of the main program will be saved in those locations as well.

Using this option on the chart, enables the chart to be taken out of the main program window. It then can be moved and re-sized anywhere on the screen. When the Page is saved, the window(s) that are outside of the main program will be saved in those locations as well.

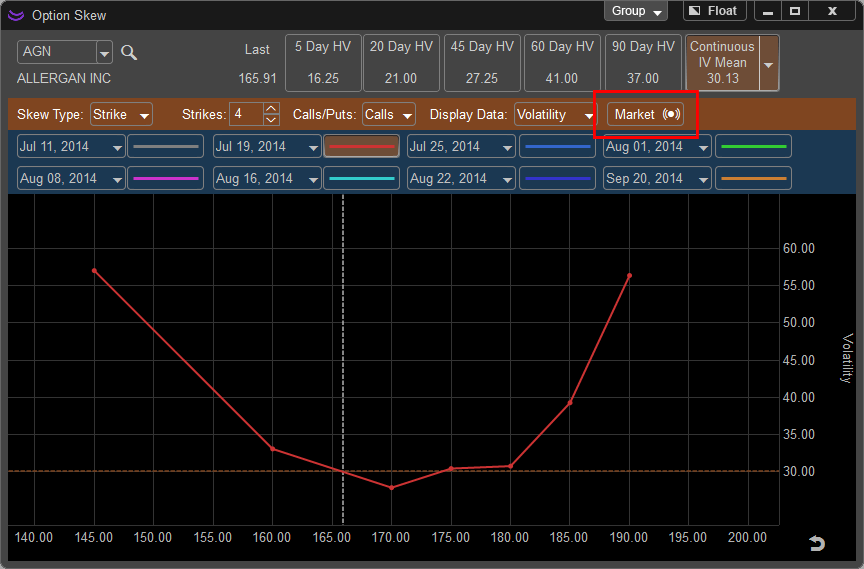

![]() This is what will be shown when a window is currently being floated outside of the main program window. To float the window outside of the main window, click on the "Dock" button.

This is what will be shown when a window is currently being floated outside of the main program window. To float the window outside of the main window, click on the "Dock" button.

A Market lock/unlock button is included to stop real time updates on the Skew Chart. This allows for further examination without seeing constant updates and skew changes.

Symbol Linking:

The Option Skew Window can be linked to other windows within the application by changing the color of the Group Function in the upper right hand corner of the window. To link the skew chart with an existing window left click on the Group Button and choose the color to match the other window within the application. When a symbol is changed both windows will update to the new symbol.

Skew Chart Types

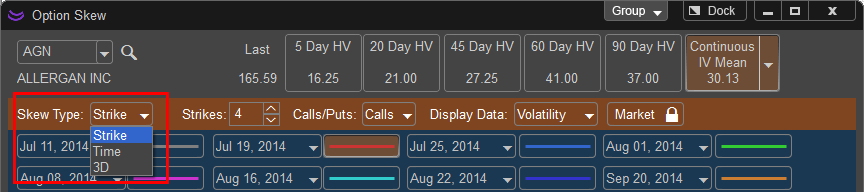

Once the symbol is chosen and the Skew Chart is populated you can choose from three different Skew Chart Types:

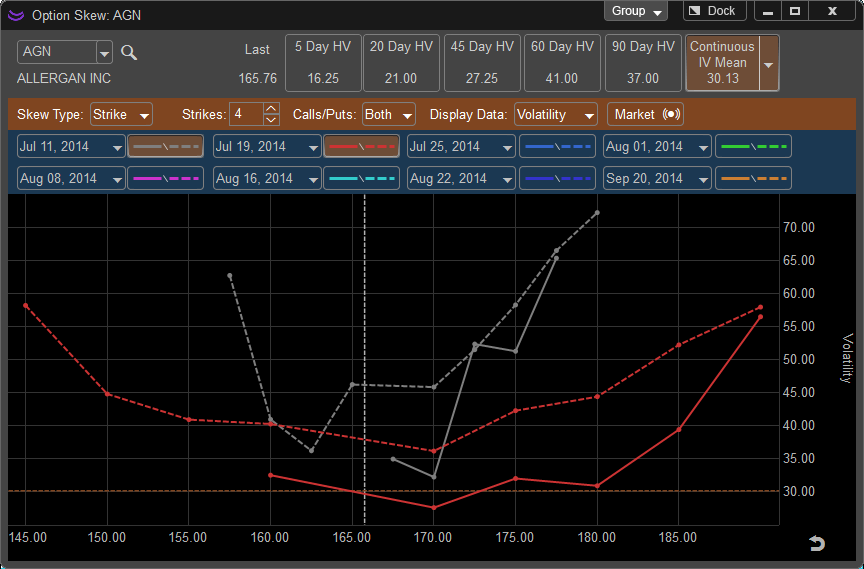

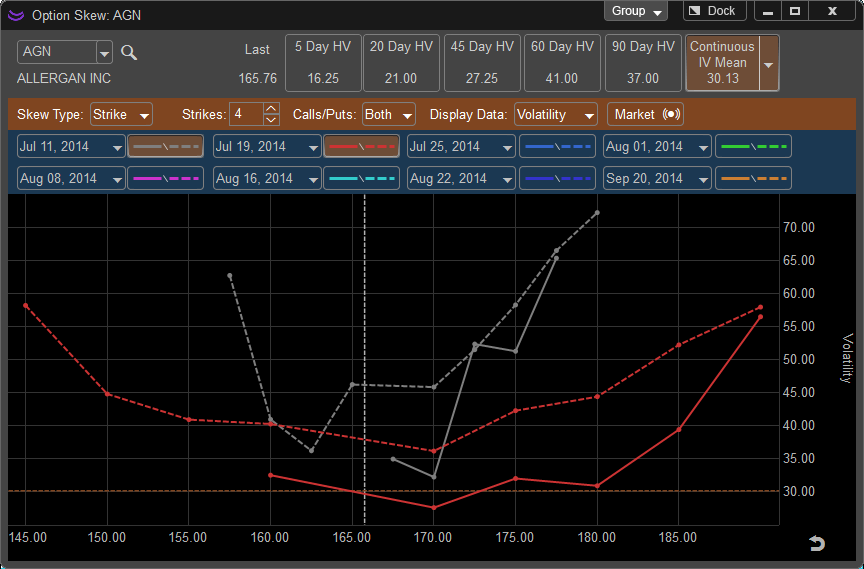

Strike: This is the default setting and will display skew of the option contract by Strike Price with the ability to view up to a maximum of six expirations. For example if the expiration of Nov 16 is selected the strike prices will be shown on the skew chart for options that expire on that day. The number of options shown and calls and puts is dependent on the settings selected in the Strike and Calls/Puts menu. The Skew Chart has two axis’ the vertical axis represents the Implied Volatility of the option and the horizontal axis represents the strike price of the option. Individual option contracts are identified on the Skew Chart by a large dot along the Skew Lines.

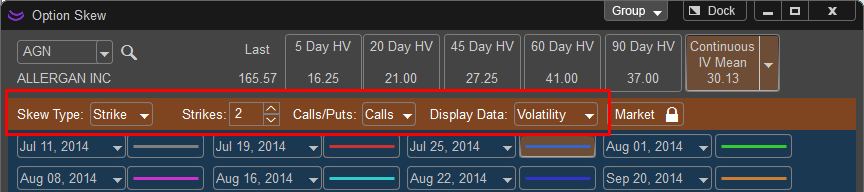

When the Skew Chart Type is set to Strike the following settings are available to modify:

Strikes: Allows the trader to select how many strike prices are displayed on the Skew Chart. If 3 is chosen the Skew Chart will show the nearest to the money Call or Put and three additional contracts in the money and out of the money.

Calls/Puts: Selects which options to show on the Skew Chart. When Calls are selected the Skew Chart will be populated by solid lines connecting the strike prices together. Puts are identified by a dotted line. The user can also select both to show Calls and Puts simultaneously.

Display Data: The Skew Chart by default is designed to show skews of Volatility but can also be used to show skews of an option contracts Delta or Theta by selecting these from this drop down menu.

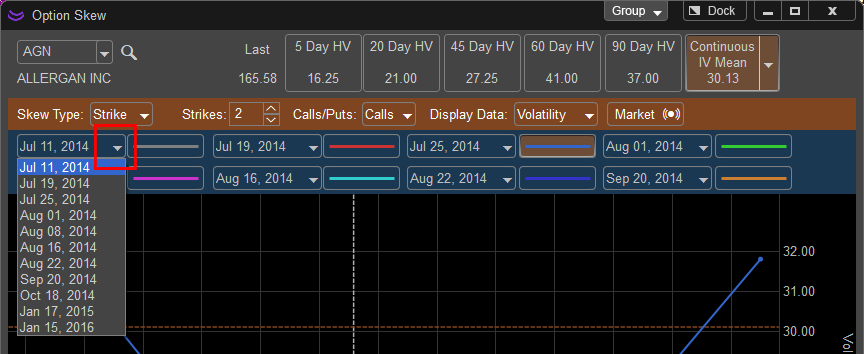

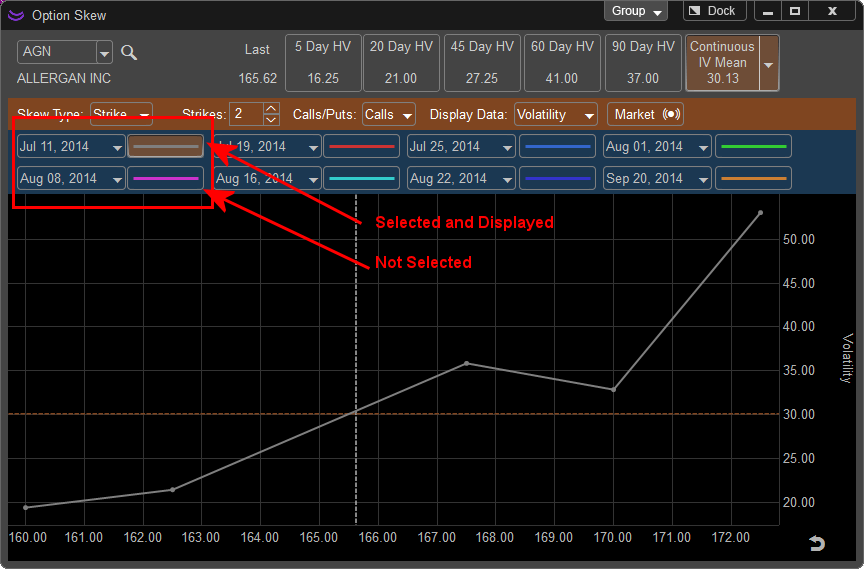

Contract Selection: Options Contracts can be chosen from the drop down menus, press the left mouse button to access the list of available expirations that can be displayed. To display them on the skew chart left click on the button to the right of the expiration drop down. Expirations that are selected for viewing will have a gold shaded button and that expiration will be identified on the skew chart by the color of the line next to the expiration chosen.