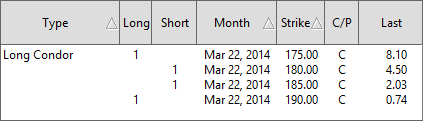

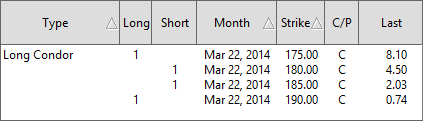

The Long Condor is a four leg option strategy designed to take advantage of low volatility neutral market conditions where the trader anticipates very little price change. The trade is initiated by selling an in the money call and buying an even deeper in the money call. The second leg is completed by selling an out of the money call and then buying an even further out of the money call.

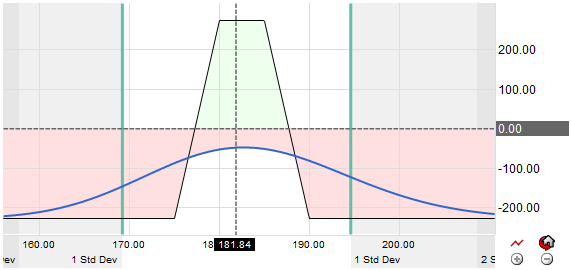

Maximum profit is achieved at expiration if the underlying stock closes in between the prices of the calls that were sold.