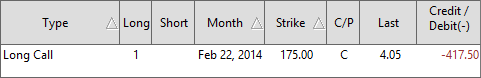

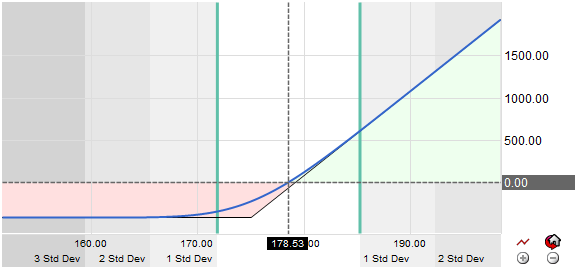

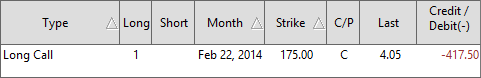

The Long Call Strategy is one of the most basic options strategies. If the trader is bullish on a stock they can purchase an options contract (Call) giving them the right to purchase 100 shares of stock on a specific date (expiration) and price (strike). The cost of the contract is multiplied by 100 creating a Debit in the trading account. This strategy can be advantageous over purchasing the stock outright as the risk is limited to the value of the Call purchased while the potential profit is unlimited.

As the stock price increase the value of the Call will increase. If the stock decreases in price the value of the option will decrease with the maximum loss being the value initially paid for the Call.