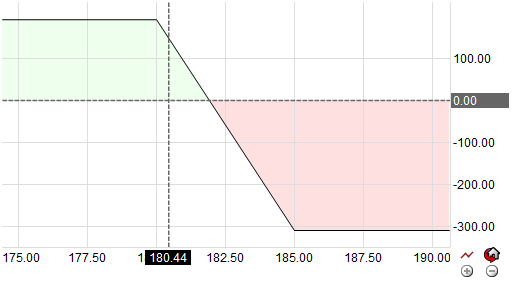

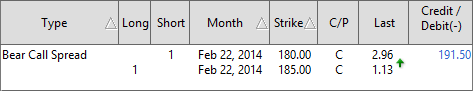

A Bear Call Spread, is a vertical spread that involves buying one higher option and selling another lower option of the same type and expiration but at a different strike price. This strategy is put on as a credit where collecting more money on the strike you wrote and less money on the strike you purchased which results in a credit.

Summary: A bear call spread is a limited risk/reward options strategy that consists of being both short and long a call option with the same expiration date. The strategy profits if the stock holds steady or declines and works best in a stagnant market. The most reward it can generate is the net premium received at the beginning when the spread enacted. If the forecast is incorrect and the stock rallies the loss grows only until the long limits the amount.